We strongly recommend starting Medicare planning at least three months before turning 65, so you have time to apply for Medicare Parts A and B, get together all necessary information you need for social security administration, and start to shopping around for the right plan.

When it comes to Medicare, each situation is unique, so one senior situation is different from another senior.

So, who is eligible for Medicare?

Us citizen or permanent resident for 5 for at least five continues years or more is eligible for Medicare, Medicare is available for younger people with disabilities and people with End-Stage Renal Disease.

There are two parts of Medicare, A hospital and B medical. You can apply and get Medicare part A for free if you have 40 quoters or ten years full time in the USA. Also, if your spouse worked and you filed a tax return jointly, and you are eligible for your spouse’s social security benefits, you can get Medicare Part A.

If you do not qualify for part A based on these criteria, you can still apply for Medicare Part A through SSA and pay a premium for it. If you paid Medicare premium for less, then 30 quarters Part A premium is $458. If you paid Medicare taxes for 30-39 quoters, part A premium will be $252

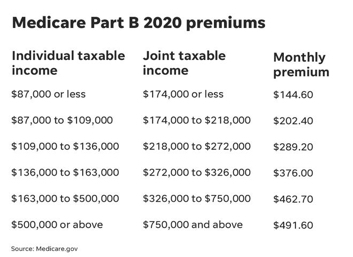

With Medicare Part B, it is a little bit easier. If you are a US citizen or permanent resident for at least five consecutive years, you are entitled to Medicare Part B for a premium. There would be a premium for Medicare Part B for everybody unless you qualified for Medicaid. The premium for Medicare Part B is $144.60 in 2020.

When you are ready to apply for Medicare, there is a couple of ways you can do that

- Online at www.SocialSecurity.gov.

- By calling Social Security at 1-800-772-1213 (TTY users 1-800-325-0778), Monday through Friday, from 7 AM to 7 PM.

- In-person at your local Social Security office.

You can look up the local Social Security office in NY on their website. Here are some offices that are located next to our office:

| Brooklyn Office | 195 Montague St Brooklyn NY 11201 |

| Brooklyn Office | 2250 Nostrand Ave Brooklyn NY 11210 |

| Brooklyn Office | 7714 17th Avenue Brooklyn NY 11214 |

| Brooklyn Office | 3386 Fulton Street Brooklyn NY 11208 |

| Brooklyn Office | 1871 Rockaway Parkway Brooklyn NY 11236 |

| Brooklyn Office | 1540 Fulton Street Brooklyn NY 11216 |

————————————————-

In some situations, you do not have to apply Medicare comes in the Mail.

In what cases Medicare comes in the Mail?

If you currently on disability for two years or more, your Medicare will arrive in the Mail automatically even if you are under 65. if you now collect Social Security benefits, you do not need to apply for Medicare, and it will automatically arrive in the Mail.

Let’s look at a straightforward scenario:

Joanne worked in the United States for 40 years, retired, and start collecting Social Security at age 62. Now she is three months before she turns 65. She is a US citizen born in the United States. Three months before her 65th birthday, she will receive a Medicare card in the Mail.

Let’s look at another scenario:

John currently holds a green card for ten plus years has 40 quarters still working but does not collect Social Security benefits and does not have group insurance through his employer. He has insurance through Obamacare. in this case, he must arrange and apply for Medicare Part A, and Part B. John cannot continue with Obamacare if he is eligible for Medicare. Unfortunately, in some cases, Medicare runs more expensive than Obamacare.

Where do you apply for Medicare?

With an online tool on the Social Security Administration website, it is very simple to apply for Medicare. You need your necessary information and an online account with the Social Security Administration.

A little tip for people who were not born in the United States.

If you were born abroad and you did not notify Social Security Administration that you became a citizen of the United States, you will still need to go to Social Security Administration and show the proof of your birth. The evidence of your birth maybe your birth certificate or naturalization certificate.

What do you need to do if you are turning 65, do not collect Social Security, and still working at the company that provides you with health insurance coverage?

In this case, you would want to apply for Medicare Part A only. After you turn 65, you are insured from a job that will be primary insurance, and Medicare Part A would be secondary. You can start applying for Part B, only when you will be retiring, and you will be losing your insurance from your job.

There will be no penalties if you have Medicare creditable coverage from your job.

Creditable coverage is health insurance, prescription drug, or other health benefit plan that meets a minimum set of qualifications. Types of creditable coverage plans cover group health plans, personal health plans, student health plans, as well as a variety of government-sponsored or government-provided programs. You’ll get this notification each year if you have drug coverage from an employer/union or other group health plan. This notice will let you know whether or not your drug coverage is “creditable.”

Some senior citizens may have different types of Medicare Creditable coverage:

- VA Benefits [ link to the Va benefits and Medicare Blog]

- TRICARE for Life

- NYSTRS

- Etc.

If you have a question about your coverage, do not hesitate to give us a call at 1-800-252-7047.

After you applied for Medicare or already got your Medicare card, you should shop for the right Medicare Plan.

The decision between Medicare Advantage Prescription Drug (MAPD or Part C) and Medicare Supplement with Part D (PDP) plan can be overwhelming. [link on the blog #3 MAPD vs. Med Sup]

What makes us different and how we can help you in this decision?

- Many different insurance companies appoint us so we can find the right fit for you, rather than having agents keep pushing you one carrier plans.

- We will look at whether your current coverage remains the best option for you, both in terms of coverage and cost.

- In Brooklyn, Medicare beneficiary has 49 Advantage Plans to choose from it is very overwhelming. We know each plan!

- We do need analysis for you. At First Manhattan Financial, we review the list of your medication and tell you your exact copay with different plans. We determine which plan has your drug in the drug formulary. It is a very important step.

- We make sure all your Dr’s participates in the program. Network is very tricky. The companies sometimes have five or more networks. We know it all!

- Our service is FREE. We get paid directly from the companies, that is why it is Free for you.

- Down the road, if you have any questions or got the bill that you can not understand, we are here to help.

- Every year during the Annual Enrollment Period, we revisit with you and make appropriate changes if we need too.

By working with us, Medicare will be easy to understand and easy to manage.

1-800-252-7047